Setting up a company in Poland

Poland has become a prime destination for real estate investment in Central Europe, drawing significant interest from international investors – including those from the Netherlands. A crucial early step for any foreign investor is deciding how to structure their business presence. This article explores the preferred Polish company structures for Dutch real estate investors, compares the ease of setting up companies in Poland versus neighboring countries, highlights recent legal and policy developments in Poland, and shares engaging statistics and examples to provide context.

To round out the picture, here are some notable statistics, case studies, and observations that highlight the context of company formation and investment in Poland, especially those relevant to Dutch real estate investors.

Dutch FDI dominance

The Netherlands is the number one foreign investor in Poland by cumulative value. As of the end of 2023, Dutch investment made up roughly 18.8% of Poland’s total inward FDI stock. This is a massive share (followed by Germany at 16.6%, and Luxembourg ~12.7%). It means that Dutch companies – whether multinationals or holding entities for global investors – have poured tens of billions into Poland. A significant slice of this is tied to real estate and construction, directly or indirectly. For instance, part of that Dutch FDI comes from international real estate funds structured through Dutch vehicles, investing in Polish shopping centers, warehouses, and offices. According to Poland’s central bank data, about 9.1% of foreign direct investment stock in Poland is in the real estate sector.

Case study – share deal via Dutch Holding

A notable case highlighting structuring was the sale of a Warsaw office complex in 2021: The Dutch owner held the asset through a Dutch BV which owned a Polish sp. z o.o. that in turn held the property. When the time came to sell, it was the Dutch BV that sold the shares of the Polish sp. z o.o. to the buyer (a fund from Germany) instead of the Polish company selling the real estate, Under the treaty? then in force, the capital gain was not taxed in Poland, and the Netherlands did not impose tax due to participation exemption. Thus, the transaction was very tax-efficient. That kind of the structure was common and one many Dutch investors have used. As noted, after the 2023 treaty change, such share sale gains are now taxable in Poland, altering the calculus for future deals. But the case is instructive: it shows how cross-border structuring (Dutch holding, Polish subsidiary) has been used to optimize real estate investments. Going forward, Dutch investors may consider similar setups but will plan for the Polish tax or explore using EU fund structures that might be exempt.

Foreign companies and location choices

Foreign investors often cluster in certain regions of Poland. It’s interesting to note that the Mazovian Voivodeship (Warsaw region) hosts the largest number of foreign-capital companies, followed by regions like Dolnośląskie (around Wrocław) and Małopolskie (Kraków). This aligns with where real estate is hottest. A Dutch investor setting up a company in Poland will likely register the seat in a major city (Warsaw being most common for holding entities, even if the property is elsewhere). There are service providers offering virtual office addresses and administration in those cities, making it easy to establish a presence without heavy overhead.

Professional assistance

Engaging Polish legal and accounting experts is a norm. There are numerousDutch-Polish consultancy firms (some even being members of the Netherlands-Poland Chamber of Commerce) catering to company formation and market entry. This ecosystem makes it easier for newcomers.

Common legal entities for Dutch investors in Polish real estate

Foreign investors entering the Polish real estate market must select a suitable legal form. While multiple corporate and partnership structures are available, each offers unique benefits and trade-offs. Below is a detailed overview of the most commonly used entities to help investors make strategic decisions.

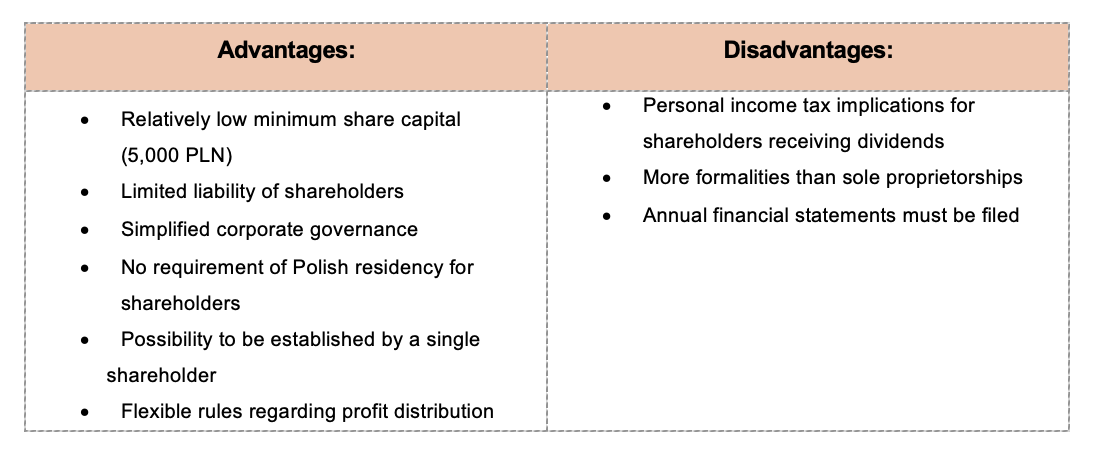

Limited liability company (spółka z ograniczoną odpowiedzialnością – sp. z o.o.)

The spółka z ograniczoną odpowiedzialnością is by far the most popular corporate vehicle for foreign investors in Poland. Approximately 95% of foreign investor company registrations in Poland are sp. z o.o. companies, and over 92% of all businesses with foreign capital in Poland operate as an sp. z o.o. This dominance is due to the fact it offers operational flexibility with limited liability protection.

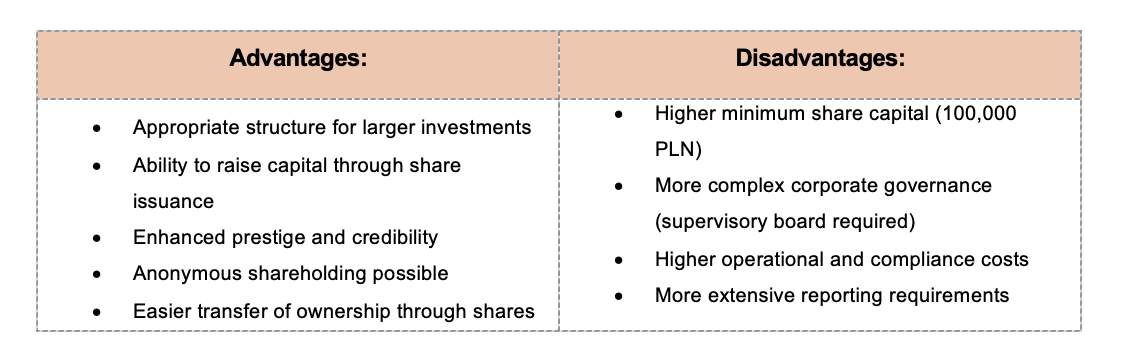

Joint-stock company (spółka akcyjna – S.A.)

The spółka akcyjna is a less common choice for typical real estate investments. Incorporation and governance requirements are more complex – for instance, a higher minimum capital and more formalized management structure (management board and supervisory board) are required. Using an S.A. is generally “unusual” for real estate entry vehicles, unless the investor plans to raise capital publicly or undertake a very large venture.

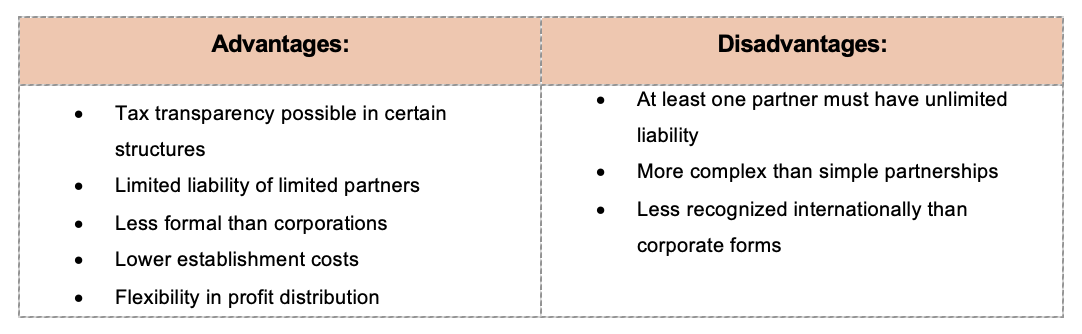

Limited partnership (spółka komandytowa – s.k.)

The spółka komandytowa was historically popular for tax planning in Polish real estate structures. In the classic model, an sp. z o.o. would serve as the general partner (with unlimited liability, but typically minimal economic stake) and the foreign investor as a limited partner – allowing profits to be taxed once at the partner level. However, a major change in 2021 altered this landscape. Since May 2021, Polish limited partnerships have been classified as corporate taxpayers (subject to CIT), ending their pass-through tax advantage. As a result, limited partnerships have become far less popular for new investments. They are now seen mostly in special cases involving individual investors or legacy structures.

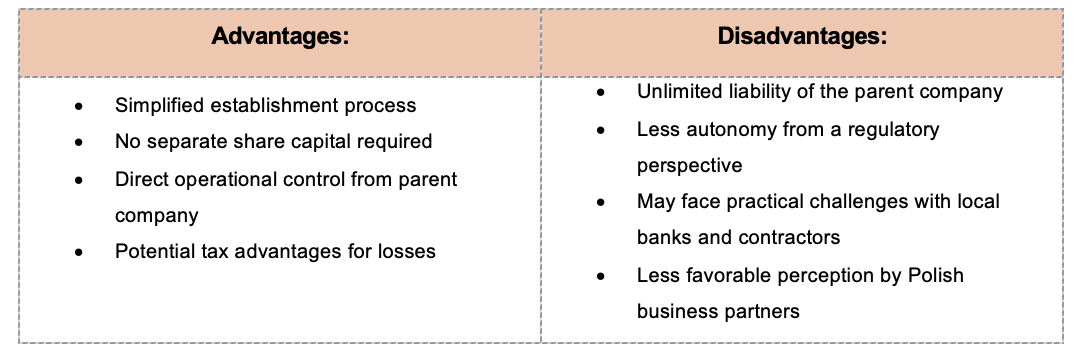

Branch office (oddział)

Some Dutch companies choose to operate via a branch office of the Dutch legal entity rather than forming a separate Polish company. A branch office (oddział) is an extension of the foreign company, conducting business in Poland in the name of that foreign entity. In practice, branches have been much less common than subsidiaries – branches accounted for only about 1% of foreign business entities in Poland.

Company registration procedure

A company is entered in the National Court Register based on an application submitted together with the necessary attachments. As of 1 July 2021, applications may only be submitted in electronic form. Applications submitted in paper form will not be processed by the registry court.

An application for registration must be submitted:

- via the Court Registers Portal (only if the articles of association or deed of incorporation were executed before a notary public), or

- via the S24 electronic system (only if the articles of association were concluded using the template available in S24).

An application through the Court Registers Portal or the S24 system may be prepared by any person who holds an account on the respective portal. It does not have to be a shareholder or an authorised representative of the company. The application for company registration may be signed exclusively by: the management board – all members jointly, or a legal representative (attorney-at-law or advocate) appointed by the management board. If the application is prepared by a person other than a member of the management board or a legal representative, that person must use the “share for signature” option to enable the authorised person to sign the application. This option is available in both registration modes.

The application must include basic information such as:

- the business name, registered office, and address of the company

- the company’s business activity

- the amount of share capital (if establishing a capital company)

- whether a shareholder may hold more than one share

- names, surnames, and addresses or electronic service addresses of the management board members, as well as the manner of the company’s representation

- a statement indicating if shareholders are making non-cash contributions to the company

- the duration of the company, if specified

- designation of the journal for the company’s announcements, if specified in the articles of association.

In both the Court Registers Portal and the S24 system, the application must be accompanied by the required documents in the form of electronic attachments, as specified below.

KRS registration (National Court Register)

National Court Register (KRS) registration is the foundational step in establishing a company in Poland. Most companies are registered electronically, and typically the procedure takes 2–4 weeks.

- Prepare the company’s articles of association (notarial deed required for most company types)

- Deposit the share capital in a Polish bank account

- Submit an application to the KRS, including:

- Registration forms

- Articles of association

- List of shareholders

- Specimen signatures of board members

- Confirmation of share capital payment

- Proof of registered office address

NIP (Tax Identification Number)

Once registered in the KRS, the company must obtain a NIP from the relevant tax authority. The number is essential for tax filings and commercial operations.

- Submit NIP-8 form to the relevant tax office

- Provide the KRS extract and articles of association

- Specify the expected revenue and tax collection methods

The tax office typically issues the NIP within 1-2 weeks.

REGON (statistical number)

The Statistical Office assigns a REGON number, usually automatically after KRS registration.

CRBR (Central Register of Beneficial Owners)

Within 7 days of KRS registration, companies must register their beneficial owners in the Central Register of Beneficial Owners (CRBR). This is part of Poland’s AML (Anti-Money Laundering) compliance.

- Identify all beneficial owners (persons with more than 25% shares/control)

- Submit information through the online CRBR system

- For submission use qualified electronic signature or trusted profile

Bank Account

To operate in Poland, the company must open a corporate bank account. Documentation requirements vary by bank but generally include:

- KRS extract, NIP and REGON certificates

- Articles of association

- Management Board resolution authorizing account opening

- Identification documents of authorized representatives

- Beneficial ownership documentation

Most Polish banks offer services in English, though documentation requirements vary.

Tax filings

Newly formed companies must register for various taxes. This process includes:

- VAT Registration – Submit VAT-R form if expected turnover exceeds PLN 200,000

- Corporate Income Tax – Registration occurs automatically with NIP

- Social Security – Register with ZUS within 7 days of hiring employees

- State Fund for Rehabilitation of Disabled Persons (PFRON) – If employing more than 25 FTE (full time employees)

Monthly reporting obligations begin immediately after registration, making it essential to establish accounting services promptly.

Foreign investors often engage local law firms or specialized service providers to navigate the registration process efficiently and ensure compliance with all requirements. While the process may seem complex, it typically takes 4-6 weeks from initiation to having a fully operational company prepared to conduct real estate transactions in Poland.

Next to come

In the next article in this series, we will guide investors through the real estate due diligence process, a cornerstone of risk mitigation in property acquisitions. The article will detail legal, technical, and financial due diligence procedures and highlight practical strategies to identify, assess, and manage the most common risks in the Polish market, including restitution claims, planning uncertainties, environmental liabilities, and more.

About authors

Walentyna Okuń, Associate from the Real Estate team at GESSEL, focuses her practice on real estate transactions, joint ventures, the development process, investment and construction matters, and leases.

Maciej Boryczko, Partner, Head of the Real Estate team at GESSEL, specializing in comprehensive and dynamic legal services for all real estate issues and processes of market stakeholders – developers, landlords, tenants, lenders and borrowers, sellers and buyers of real estate.

About GESSEL

For over 30 years, GESSEL law firm has been a trusted partner for the business community both in Poland and internationally, offering a client-centric approach that adapts legal services to unique needs. By supporting clients at every stage of their company’s journey, from initial investments to long-term growth, GESSEL has earned a reputation as a comprehensive legal advisor committed to delivering efficiency and success.

Drawing on extensive experience across various sectors – including finance, construction, real estate, food and beverage, transportation, retail, pharmaceuticals, energy, and IT – the firm is well-equipped to address the most demanding business matters. This versatility is reflected in GESSEL’s consistent presence at the top of both national and international legal rankings, underscoring the enduring trust its clients place in its expertise.

A nearly 100-member team is renowned for delivering practical legal solutions that safeguard client interests, while also driving their projects forward with speed and precision. By combining multidisciplinary knowledge with a deep understanding of the business world, GESSEL ensures that every client benefits from comprehensive advice that supports their vision for success.