Poland’s Value Added Tax (VAT) system plays a central role in the country’s tax landscape. Whether you’re a local entrepreneur or a foreign company, understanding how VAT operates is critical for legal compliance and efficient operations.

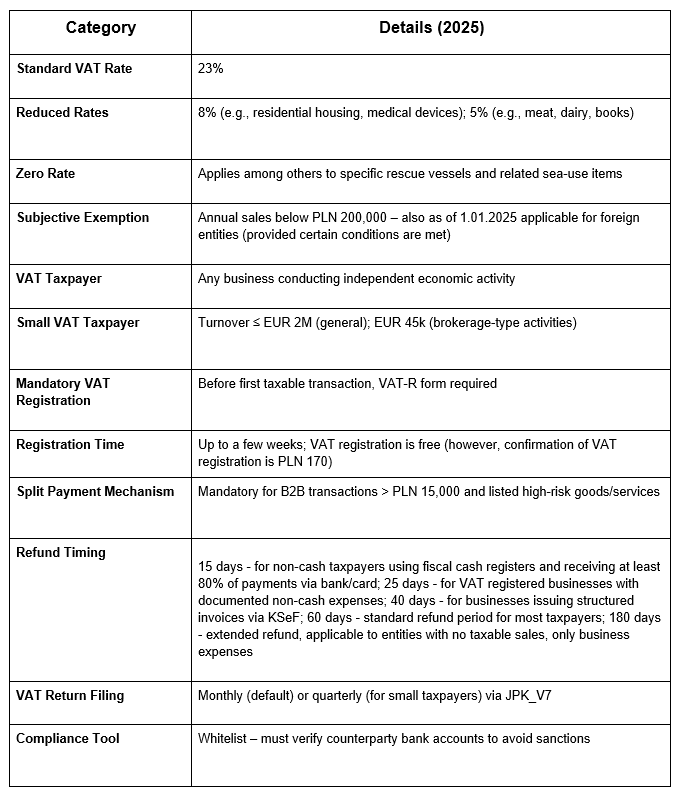

Key VAT Facts Overview

Who Must Register for VAT in Poland and When?

Businesses – both domestic and foreign – must register for VAT before their first taxable activity. Foreign companies without a Polish or EU establishment need to appoint a tax representative responsible for compliance.

Understanding VAT Exemptions in Poland

In Poland, VAT exemptions are twofold:

- Subjective: Applies to businesses with turnover not exceeding PLN 200,000/year.

- Objective: Covers specific services such as financial, educational, insurance, and residential rentals.

Note: Even exempt businesses may voluntarily opt-in for VAT.

How the VAT Split Payment System Works in Poland:

In this system, payments are split automatically by the bank:

- Net amount → seller’s main account

- VAT portion → VAT-specific bank account (assigned by the bank)

Split payment enhances VAT compliance and is perceived as a tool which increases the level of due diligence in B2B transactions. .

Which Transactions Are Covered by the Split VAT Payment?

Split VAT applies to B2B transactions in Poland where:

- Invoice total exceeds PLN 15,000

- The product/service falls under the designated high-risk categories, such as:

- Construction materials

- Electronics

- Hard coal and brown coal

- Scrap and recyclables

- Vehicle parts

How to File VAT Returns in Poland?

Businesses must submit their VAT returns as follows:

- Monthly – Default mode using the VAT-7 form,

- Quarterly – Available only for small VAT taxpayers.

Returns are submitted electronically via SAF-T (JPK_V7) by the 25th day of the following month.

What Is the VAT White List and Why It Matters?

The White List is a government-maintained database of all VAT-active and exempt taxpayers. It includes:

- Company registration status,

- Assigned bank accounts,

- Names of representatives.

If you pay more than PLN 15,000 to an account not listed, you may:

- Lose the ability to deduct it as a tax expense,

- Be jointly liable for your vendor’s unpaid VAT.

How VAT Refunds Work in Poland?

Businesses can reclaim VAT if input VAT > output VAT. The VAT-7 return is the standard form used.

Basic Refund Deadlines

- 60 days – Standard timeframe,

- 180 days – If no business activity but input VAT incurred,

- 25 days – for VAT registered businesses with documented non-cash expenses.

Avoiding Penalties Under Polish VAT Law

Failure to comply with VAT regulations can lead to:

- Loss of deductibility of business expenses (for unlisted accounts),

- Joint liability for unpaid VAT of suppliers,

- Delayed or denied VAT refunds,

- Administrative or financial penalties.

To stay compliant:

- Register on time,

- File correct returns (monthly or quarterly),

- Use listed accounts,

- Apply split payment when mandatory,

- Verify partners via the White List.

VAT Compliance in 2025

Poland’s VAT framework is comprehensive yet accessible for well-prepared businesses. By understanding rates, exemptions, refund processes, and tools like the split payment and White List, businesses can operate smoothly and legally within Poland.

Whether you’re just starting or expanding, VAT compliance is not optional – it’s a vital part of your success in the Polish market. Failure to comply may result in serious consequences, including denied refunds, financial penalties, loss of deductible expenses, and even joint liability for unpaid tax. If you need guidance or support with VAT matters, feel free to contact our tax team – we’ll be happy to assist.